UK ETS for Shipping (2026): Scope, Costs & Compliance

SummaryIntroductionScope of Coverage Compliance Costs: Beyond Allowance Purchases Offset OpportunitySmart Compliance Strategy: 5 Steps to Prepare ConclusionShare

-

Share

-

Introduction

The UK, Scottish, and Welsh Governments, alongside Northern Ireland’s DAERA, have released an interim response detailing the expansion of the UK Emissions Trading Scheme (UK ETS) to cover maritime activities starting 1 July 2026. This move aims to help operators prepare for compliance and support regulatory onboarding. Here’s what the industry needs to know:

Scope of Coverage

- Applies to ships ≥5,000 GT operating in UK waters.

- Covers all domestic voyages (between UK ports or round trips from one UK port) and all in-port emissions.

- Includes CO₂, methane (CH₄), and nitrous oxide (N₂O) emissions from combustion and slippage. (CH₄ and N₂O will be converted to CO₂ equivalents -CH₄: GWP 28; N₂O: GWP 265).

- Also applies to non-cargo/passenger vessels (e.g., offshore ships), even if exempt from current UK MRV rules.

- Exemptions: Government non-commercial vessels, Crown Dependencies, and Overseas Territories (under review)

Compliance Costs: Beyond Allowance Purchases

While carbon allowance costs will dominate (prices tracked to UK ETS market), hidden expenses loom:

- Verification: Mandatory annual audits by UKAS-accredited verifiers

- Admin Burden: Developing EMPs, emissions monitoring, and reporting

- Penalties: Significant fines mirroring other UK ETS sectors for missed deadlines or inaccurate data

- Tech/Staff: Potential need for monitoring systems or compliance personnel

Offset Opportunity

Sustainable fuels (bio and non-bio) enjoy zero-rated emissions from Day 1 under UK ETS, meaning operators using biofuels or other renewable alternatives won’t need to surrender allowances for these voyages. Early adopters can significantly reduce exposure to volatile carbon prices, secure charterer preference, and improve CII scores while positioning their fleets as ESG leaders.

Smart Compliance Strategy: 5 Steps to Prepare

1. Lock Down Responsibility

- Default: The registered ship owner.

- Option: Transfer to ISM Company via binding agreement (submit proof to regulator)

- Action: Finalize contracts by Q1 2026.

2. Leverage Existing Frameworks

Reuse EU MRV EMPs: Adapt current Monitoring Plans for UK ETS with minor additions . Combine Reporting: Operators using combined MRV/DCS reporting may auto-satisfy UK ETS requirements.

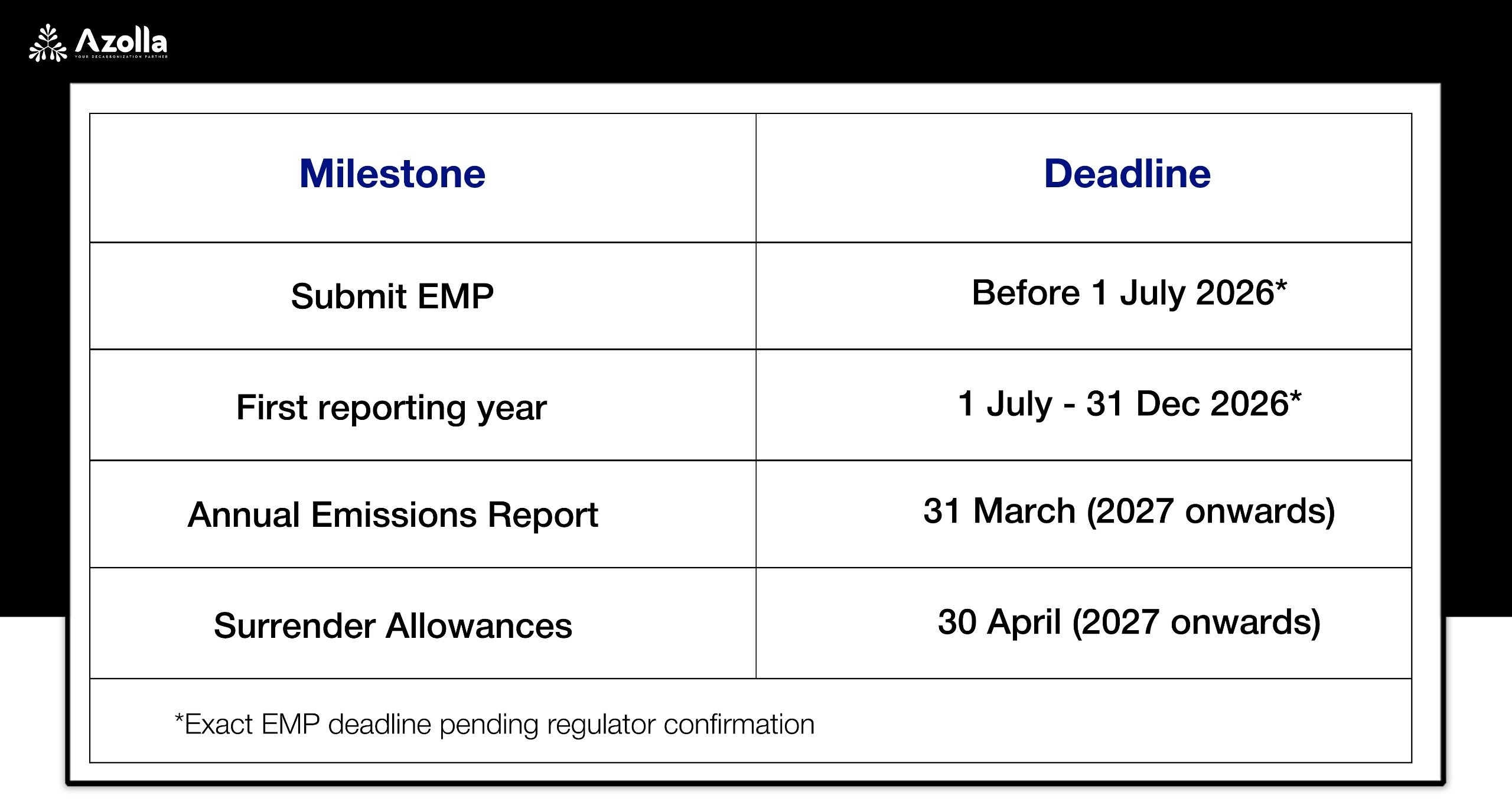

3. Master Deadlines

4. Engage Regulators Early - Voluntary Onboarding: Use 2025 to test systems (e.g., England’s METS portal) at no cost.

- Regulator Contacts:

England/Int’l: EA (etmaritimehelp@environment-agency.gov.uk)

Scotland: SEPA (emission.trading@sepa.org.uk)

Wales: NRW (GHGHelp@cyfoethnaturiolcymru.gov.uk)

NI: NIEA (emissions.trading@daera-ni.gov.uk)

5. Plan for Verification

Verifiers will offer accredited services once approved. Budget for these fees early

Conclusion

The UK ETS maritime scheme introduces a structured and pragmatic pathway to regulating emissions from domestic shipping, aligning closely with the EU ETS while expanding coverage to include methane, nitrous oxide, and in-port emissions. Operators will be required to submit a UK-approved Monitoring Plan (EMP) and a single Annual Emissions Report, ensuring consistency and minimising administrative burden.

Responsibility defaults to the Registered Owner, unless contractually delegated to the ISM Company. Sustainable fuels will be zero-rated under a Tank-to-Wake methodology, offering an immediate offset opportunity—especially valuable as allowance prices fluctuate.

But beyond compliance, this is a moment for strategic advantage.

Operators who act early—by engaging regulators, adapting existing systems, and clarifying charterparty clauses—can manage costs proactively, reduce risk exposure, and unlock long-term decarbonisation benefits.

Azolla is already supporting fleets navigating EU ETS, FuelEU Maritime, and upcoming UK ETS compliance. Book a 15-minute consult to understand how Azolla can help you build your UK ETS strategy today.

Reach out to us at ets@azolla.sg

Share

-

Contact us today to embark on a journey of discovery.optimization.maritime leadership.discovery.